29 Apr First Step to Creating an Effective Budget

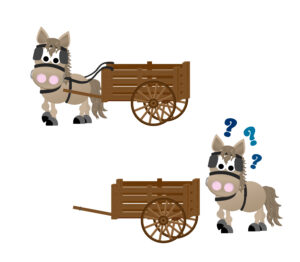

Most financial advisors recommend creating a budget as one of the first steps towards financial health. To me, prematurely creating a budget is the financial equivalent of putting the cart before the horse.

Just like a cart isn’t going to get anywhere without a horse to lead it, a budget can’t effectively map out a direction for our money if we don’t have a positive relationship with money itself.

When financial advisors recommend a budget or the more accurate and friendly-sounding “spending plan,” they assume people have enough of a relationship with their finances that they know:

- where their money goes

- where their money comes from

- how much their expenses are

- how much they need to save to reach their goals

And the list goes on.

If our relationship with money is fraught with negative or conflicting emotions, being asked to account for every penny is like being asked to take a swim in a toxic lake. No matter how good your backstroke is, in the end you’ll probably end up less healthy than you started.

Take for example someone who grew up in a family where money was a continual source of conflict, who therefore learned that money/paying bills/dealing with finances is a negative experience that leaves people angry and frustrated and disconnected from their loved ones and perhaps even that there will never be enough money anyway, so why bother? Chances are that when it comes time to pay their bills or even check their bank account, they find something, anything else to do. Even cleaning the grout in the shower sounds more enticing.

When they decide that it is finally time to FACE their finances and sign up for financial education or start reading personal finance books they learn that the first step is to ……CREATE a budget. And so they optimistically sit down to CREATE the budget. Then the subconscious discomfort sets in. They begin to fill twitchy, their mind wanders or they just plain shut down, which in turn further PROVES to them that they are terrible with money, stupid, or undisciplined. So that shame compounds their fear with money. And all because they haven’t addressed their personal feelings around money.

If this sounds like you or someone you know, stay tuned for my next blog, where I’ll share some ideas on how to create a positive relationship with your money so that you can be the BUDGET NINJA of your dreams.

Katy Eckel

Posted at 10:39h, 30 AprilGreat information. Going to share it with my family.

Julia Kramer

Posted at 12:51h, 30 Aprilthanks 🙂 I would love to hear any thoughts they have!!!